This is a tale of how two drastically different classes create wealth--the extremely wealthy, and the rest of us. I know all things are relative, so to be clear I’m referring to this group as the top wealthiest individuals.According to the Credit Suisse Research Institute's Global Wealth Report the richest 1% of the population now owns over half of the world’s wealth.

That’s a staggering statistic. How can it be true?

First, let’s take a look at how “wealth” is defined. The report defines it as “the abundance of valuable resources or valuable material ownership”, and I’d wager that when most of us think of wealth, we think of it terms of accumulation of those things.

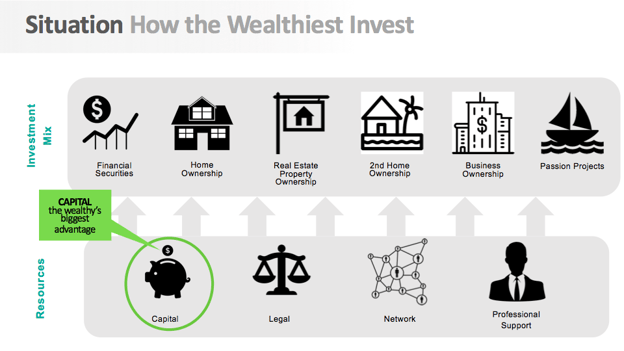

And the wealthy accumulate well. The wealthiest have a diverse asset mix, which of course includes big 401(k)s and various brokerage accounts, and ownership of their primary home.

But these investors don't stop there. It’s reported that 90% of millionaires own numerous and diverse real estate investments, They own second homes, vacation homes for their personal use, and commercial or residential real estate investments--all of which are key assets in their investment portfolios.

They also invest in business and entrepreneurial ventures--for the rich, business ownership is a kingpin to their wealth building success. And because they can, they invest in recreation and things they're passionate about, like buying yachts, vintage cars or precious works of art. Note

We can certainly learn a lot from this group of investors, but it’s no secret how they do it.

They have an abundance of resources.

The most important resource of the wealthy is capital--and not just money capital. They have the best attorneys, accountants, and business advisors at the ready. They also have a powerful and well-established network of friends and fellow investors who are always introducing them to new deals and business opportunities.

Their tale of wealth creation doesn’t exactly have the conflict of a bestselling novel.

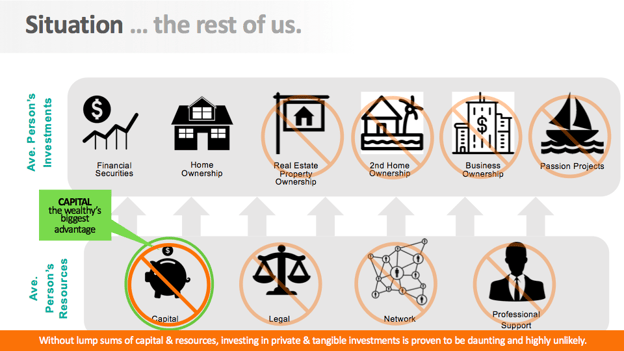

But it’s different for the rest of us who desire to create wealth. Our stories don’t usually include these resources-- the capital, the know-how, the network or expertise.

And as a result, everything after primary home ownership and a work-benefit 401(k) are assets in a wealth-building mix that are, or seem, out of reach.

These other investments -- the “Dream Investments” as we call them at TribeVest -- seem out of reach because most of us don’t have access to large lump amounts of capital. Almost all dream investments require more capital. And if we want to successfully own and manage these investments, we ’d better have cash flow as well.

At TribeVest, we’re passionate about a tale of wealth accumulation for everyone other than the richest 1% of the world that includes group investing to grow capital and go after those dream investments that seem so out of reach. We invite you to explore how TribeVest simplifies group investing, empowering individuals to save with purpose and achieve dream investments together. TribeVest is transforming the way people create your own wealth.

Sign up to follow our blog to learn more about the tribe investing movement.

Talk soon,

Travis